Call Us 03 9671 4990

The power of the Age Pension

We recently met with a couple who had just turned 67, the age when Australians currently become eligible for the Age Pension. They had done well to build up around $1 million in combined super and asked the question many people have at this stage:

“Will this be enough to fund our retirement?”

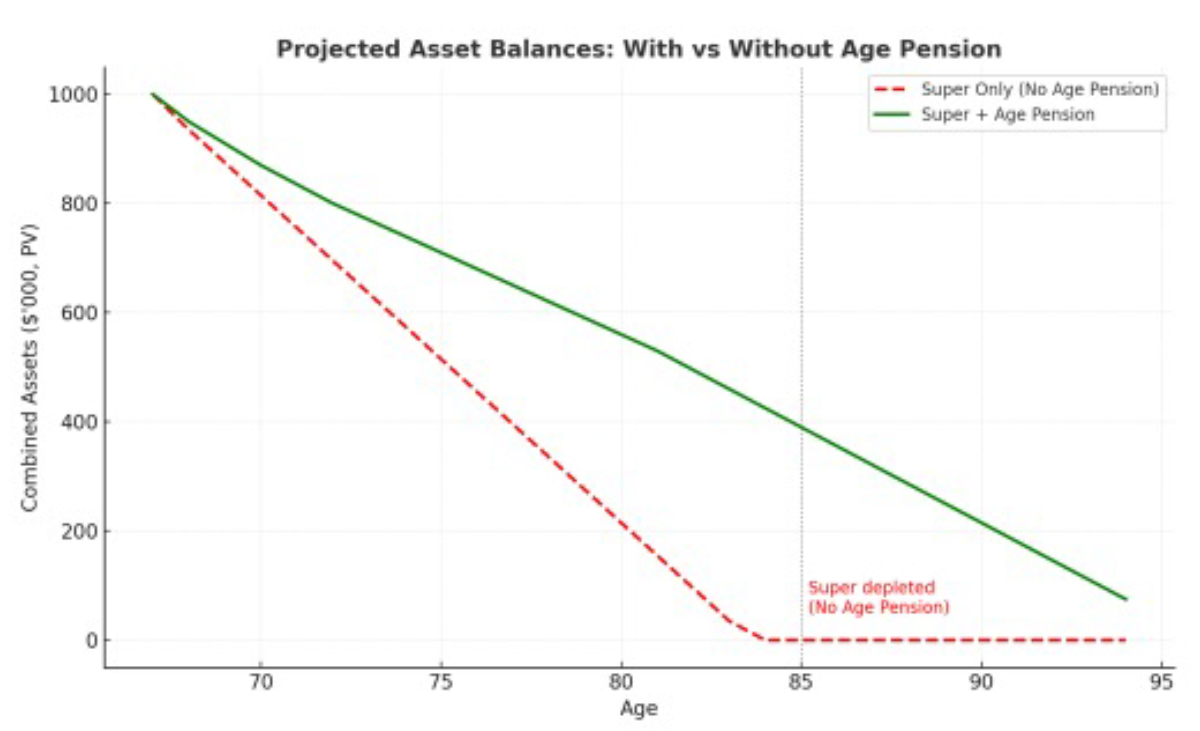

To find out, we modelled two scenarios: one without the Age Pension and one with it. We also assumed they wanted to spend $70,000 per year in today’s dollars (indexed for inflation in the modelling), plus occasional car upgrades of $50,000 (present value) at ages 67, 73, and 80.

The difference between the two scenarios was striking.

Scenario 1: Super Only (No Age Pension)

In the early years, they could comfortably meet their $70k p.a. lifestyle spending. But because withdrawals and car upgrades were greater than the earnings generated by their super, their balance steadily declined. By their mid-80s, their super was nearly gone, and by their late 80s (around 85–86), their account was completely depleted.

This is the classic fear for many retirees: “What if I outlive my money?”

Scenario 2: Super + Age Pension

Next, we included the Age Pension.

Even at 67, with $1 million in super, they qualified for a small part Age Pension. As their super reduced, their entitlement increased each year.

By their mid-70s, the Age Pension had grown into a meaningful contribution. From then on, the combined super drawdowns + Age Pension not only met their needs but began to generate surpluses each year, which built up in their cash account.

And here’s the key difference: at the same point their super was exhausted with no Age Pension (around age 85–86), they still had around $400,000–500,000 in assets plus a guaranteed Age Pension income stream for life.

Here’s how their super balance looks with and without the Age Pension:

The contrast between the two models shows how powerful the Age Pension can be:

- Without Age Pension → assets deplete by the mid-80s.

- With Age Pension → income lasts for life, and you still retain meaningful assets well beyond.

Even with $1 million in super and extra lump-sum spending, the Age Pension can provide:

- Longevity protection – income that grows as super reduces.

- Peace of mind – you won’t be left with nothing.

- Flexibility – surpluses later in life can help with healthcare, aged care, or supporting family.

Not everyone retires with $1 million in super, using the same assumptions as above, if a couple started with around $600,000, their super would run out by about age 75 without any Age Pension support. But when the Age Pension is included, income continues for life and their assets last well into their late 90s, providing the same peace of mind and protection as in the $1m scenario.

This demonstrates that the Age Pension isn’t just for people with little savings, it’s designed to complement super, ensuring income lasts for life and reducing the fear of running out. That’s why retirement planning isn’t only about how much you’ve saved, but also how the system supports you along the way.

If you’d like to understand how the Age Pension and your super can work together, or any other part of your financial plan, we’d love to help.

This article is designed to educate and inform by showing how the Age Pension can work alongside super, but it won’t apply to everyone. Eligibility varies depending on your assets, income, and personal circumstances. This article provides general information only and does not take into account your personal circumstances, you should seek personalised financial advice before making any decisions.

Thank you but I believe that with Rancie’s help, we have this covered. Cheers

How do they get an Age Pension with that amount of super???

Thanks for the questions, as at 20 September 2025, a couple who own their home can have up to $1,074,000 in combined assessable assets (excluding the family home) before their Age Pension entitlement cuts out completely. Here is a link to the Services Australia website page: https://www.servicesaustralia.gov.au/assets-test-for-age-pension?context=22526